Preparing Emergency Funds for Home and Property Investments

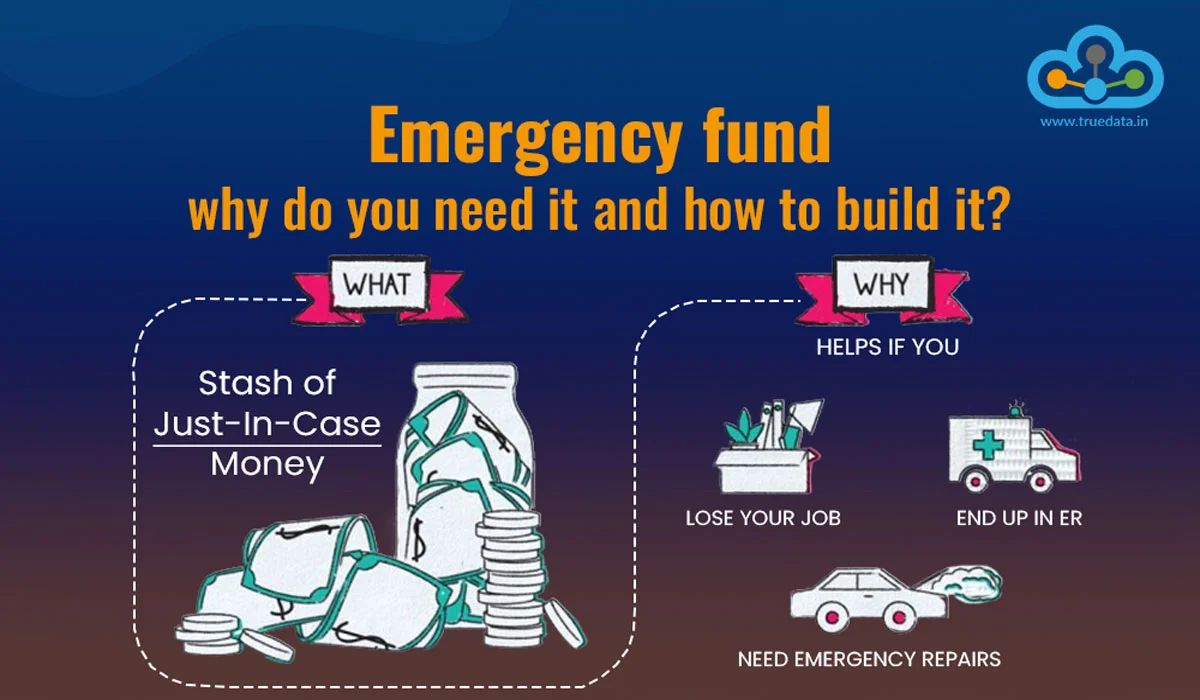

Having an emergency fund for home and property investments is very important to be able to face unexpected situations financially.

Setting up an emergency fund for home and property investments is a wise move to ensure financial stability despite risks. Below Buy Home Site – Helping You Find Your Pe… will discuss effective ways to prepare the right emergency funds for home and property investments.

Emergency Fund for Property Investment

Emergency funds for home and property investments are crucial to avoid future financial problems. When deciding to invest in property, we must be prepared for unexpected situations that could disrupt cash flow. For example, urgent maintenance costs or unexpected property repairs.

In these cases, an emergency fund serves as a buffer, ensuring that the home or property investment continues to run smoothly even if financial disruptions occur. By having sufficient emergency funds, we can feel more at ease during the investment process without being disrupted by economic uncertainty. Allocating an emergency fund also helps ensure that we don’t have to sell the property just to meet urgent needs.

Building an Emergency Fund for Property Investment

Building an emergency fund for home and property investments is not difficult. The first step is to determine the amount you need to set aside. Generally, it is recommended to set aside an emergency fund equivalent to at least 3-6 months of your total monthly expenses. This includes property operating costs, installments, and other unexpected expenses.

Next, choose a safe and easily accessible instrument to store these funds. Savings or short-term deposits can be good options. Emergency funds should remain liquid so they can be used immediately when needed. Don’t let your emergency funds get locked up in investments that can’t be quickly liquidated. If you have a sufficient emergency fund, your property investment will be safer and more stable.

Also Read: Living Your Best Life: Smart Tips for Lifestyle and Home Ownership Success

Emergency Funds in Property Investment Security

Having an emergency fund for your home and property investments also means preparing for market fluctuations. The property market isn’t always stable. There are times when property prices drop drastically or economic crises impact the property sector. Having an emergency fund allows you to weather these fluctuations without having to sell your property at an inopportune time.

An emergency fund also gives you the freedom to wait until the market recovers. Furthermore, an emergency fund allows you to continue meeting obligations such as installments or property maintenance without rushing to find additional funds. This is an important financial safeguard for every property investor.

Determining the Right Amount of Emergency Funds

Determining the size of your emergency fund for your home and property investments depends heavily on your goals and risk profile. The larger the property you invest in, the larger the emergency fund you need to set aside.

This ensures you can cover potential costs without jeopardizing your financial stability. Other factors include maintenance costs, renovations, and other unexpected expenses that can arise at any time. You must be realistic in calculating your emergency fund needs to avoid running out of funds when needed. A well-prepared emergency fund will provide a sense of security and comfort when investing in property.

Managing Emergency Funds for Property Investment

Managing emergency funds for home and property investments is crucial to maintaining their effectiveness. One way is to regularly monitor your balance and evaluate your emergency fund needs according to changing circumstances.

If the property you’re investing in develops and requires additional expenses, you should be prepared to increase your emergency fund to cover these new expenses. Furthermore, ensure your emergency fund is always stored in a safe and easily accessible place in case of an emergency. Managing your emergency fund wisely will ensure your property investment runs smoothly without any financial obstacles.

Image Information Source:

- First Image from: www.thejakartapost.com

- Second Image from: www.truedata.in